The Latest Tax Scam Targeting South Africans

A new fraud scheme targeting South African taxpayers through deceptive email communications has emerged. Criminals are actively distributing fraudulent emails that claim to be from the South African Revenue Service (SARS). These phishing attempts follow a simple but dangerous pattern: victims receive official-looking emails claiming they have outstanding tax fees that require immediate payment. The scammers then provide fake banking details, attempting to redirect legitimate tax payments into their accounts.

How to Identify These Fraudulent Emails

- Emails are sent randomly to South African email addresses

- Messages claim outstanding fees are owed to SARS

- Scammers provide counterfeit banking information for payments

- Communications often create a false sense of urgency

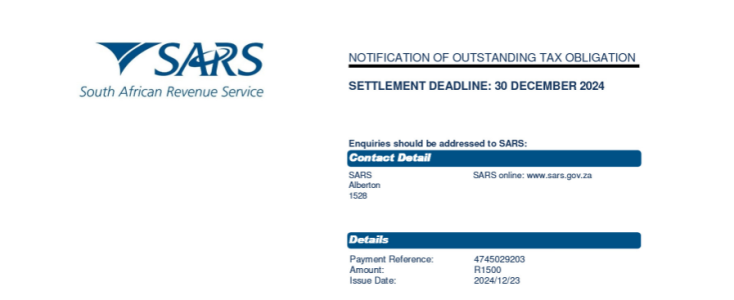

Example of Fraudulent SARS Document:

NOTIFICATION OF OUTSTANDING TAX OBLIGATION

This serves as an official notification that an overdue tax debt amounting to R1,500.00 has been identified under your account. Immediate settlement of this outstanding amount is required.

Kindly make payment into the banking details provided below, using the specified payment reference, by no later than 30 December 2024:

Payment Reference: 47xxxxxx

Account Name: SARS

Outstanding Amount: R1500

Instant / Immediate payment to: ABSA 4xxxxxxx

Only use payment reference above to enable us capture your payment.

Important Notice: If payment is not received on or before the specified date, the South African Revenue Service (SARS) reserves the right to initiate legal proceedings and impose additional penalties in accordance with Section 95(1)(a) of the Tax Administration Act 28 of 2011.

Non-compliance, whether intentional or accidental, is a punishable offence and may result in fines or imprisonment of up to two years upon conviction.

We strongly urge you to act promptly to resolve this matter and avoid any unnecessary escalation.

Sincerely

ON BEHALF OF THE COMMISSIONER FOR THE SOUTH AFRICAN REVENUE SERVICE

How to Spot a Fraudulent Document:

Missing or Suspicious Contact Information

When examining emails claiming to be from SARS, pay careful attention to the contact details provided. Scammers often deliberately omit SARS phone numbers to prevent you from verifying the legitimacy of their claims. In cases where phone numbers are included, these may direct you to the scammers themselves rather than genuine SARS representatives. Always independently verify any contact numbers by:

- Searching for official SARS contact numbers online

- Using only the numbers listed on SARS' official website

- Never calling numbers provided directly in suspicious emails

Lack of Personal Tax Information

Another red flag is the absence of your personal tax reference number in these fraudulent communications. Scammers typically send mass emails without specific taxpayer details because they don't have access to actual SARS data. Even if a tax reference number is included in the email:- Verify that it matches your actual SARS tax number

- Check the number against your previous tax documents

- Confirm through your eFiling account or directly with SARS

Useful Links

Scams and Phishing | South African Revenue Service

You need to be aware of email scams, and so we’ve created a section of the website where we will post updates of any scams we have heard about. Similarly, we